Fraud Detection

Data analysis enables you to become more proactive when dealing with fraud detection. In the past you may have used techniques such as random sampling either as an automated task or, even worse, as a manual time consuming task. The reality is that with the volume of transactions flowing through organisations today a gap in the level of scrutiny over individual transactions has opened up the door to abuse.

Applying the correct data analytics techniques to fraud detection in your business can have a significant impact in early warning, detection and monitoring of fraud. This in turn allows your organisation to extract, analyse and derive insight from your business data to help you implement effective fraud detection systems.

The ACFE, the world's largest anti-fraud organisation, estimates that a typical organisation loses 5 percent of its revenues to fraud each year. Having a custom Fraud Detection system set up and trained on your data can help you reduce the risk of fraud occurring in your business.

Identify Hidden Patterns

Utilising the power of unsupervised or non-rules-based analytics built upon advanced algorithms can uncover new patters and trends that can indicate and highlight fraudulent schemes and scenarios that traditional approaches can often miss. It can be the case that analytics from new angles can illuminate previously unseen connections that were simply not visible before.

Proactive Identification

Traditional approaches typically analyse fraud as it is happening or even after its occurrence. Don't simply be reactive to fraudulent activities. Make use of your data and our data analytic techniques to seek out indicators of fraud much sooner and stop it before it becomes material and creates financial damage.

Continuous Monitoring

Advanced machine learning techniques allow for improvements in relation to cyclical fraud detection. Setting up continuous monitoring and detection solutions allows your business a greater potential to catch fraudulent activities before they become damaging.

Increased Accuracy

The amount of data surrounding your business and its operations has never been greater than it is today. With all that data it is impossible for manual fraud detection techniques to keep up and random sampling simply is not inclusive enough. Utilising advanced data science machine learning techniques is the easiest way to accurately process such large volumes of data.

|

Enterprise Wide ApproachFraud analytics can pull data from across your organization into one central platform, helping create a true, enterprise-wide approach. |

|

Examine InterdependenciesFraudulent activities often exploit connections across many areas of an organisation. Applying the correct fraud analytics techniques can allow you to connect the dots across your data and throughout your business. |

|

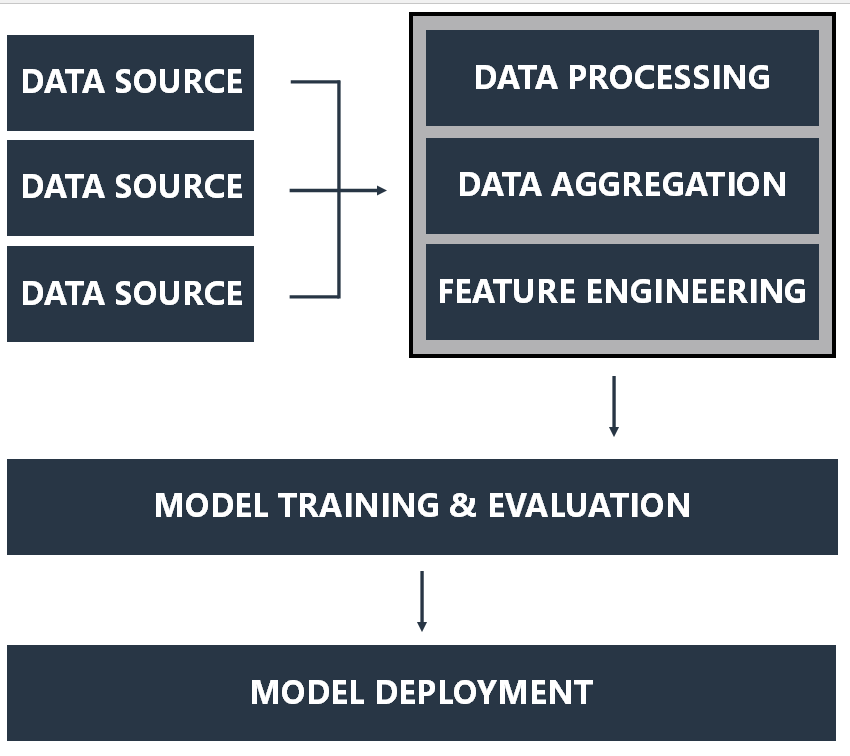

Universal Data SourcesBoth unstructured and structured data can be, and should be, used for fraud detection. Our solutions will make use of both types of data and can connect to virtually any data source that your organisation may have. |

|

Limit False PositivesYour fraud detection systems should have as little impact as possible on your legitimate customers. The improved accuracy of fraud analytics through data science can help limit the number of false positives. |

|

Detect InterconnectednessInnovative techniques used in fraud analytics can reveal unexpected, yet systematic, relationships between fraud participants and can lead to uncovering larger fraudulent operations. |

|

Identify Low Incidence EventsFinding events that occur infrequently is extremely difficult. Harnessing the power of advanced analytic techniques can make this task far easier than before. |